Verena Hagspiel

Verena Hagspiel is a Professor of Investment and Finance in the Department of Industrial Economics and Technology Management at the Norwegian University of Science and Technology. Her primary fields of interest are quantitative finance, industrial organization, microeconomics and operations management. Specifically she applies financial and operational methods for analyzing investment decisions under uncertainty. She is interested in how dynamics and uncertainty affect the firm’s investment and innovation behavior.

Recent News

-

Cost effective development of small discoveries on the Norwegian Continental ShelfOctober 20, 2021My PhD student, Semyon Fedorov, addresses in his project one of the challenges that the Norwegian petroleum industry is facing right now; the decreasing area size of new discoveries on the Norwegian Continental Shelf (NCS). Semyon’s PhD project is a part of BRU21, NTNU’s research and innovation program in digital and automation solutions for the oil and gas industry. His work focuses on hydrocarbon production economics and investment under uncertainty. The project is sponsored by OKEA ASA, a Norwegian oil company founded in 2015 and headquartered in Trondheim. Semyon’s research aims to facilitate the uptake of advanced techniques for investment...

Cost effective development of small discoveries on the Norwegian Continental ShelfOctober 20, 2021My PhD student, Semyon Fedorov, addresses in his project one of the challenges that the Norwegian petroleum industry is facing right now; the decreasing area size of new discoveries on the Norwegian Continental Shelf (NCS). Semyon’s PhD project is a part of BRU21, NTNU’s research and innovation program in digital and automation solutions for the oil and gas industry. His work focuses on hydrocarbon production economics and investment under uncertainty. The project is sponsored by OKEA ASA, a Norwegian oil company founded in 2015 and headquartered in Trondheim. Semyon’s research aims to facilitate the uptake of advanced techniques for investment... -

InvestExL: Investment under Uncertainty in the Future Energy Systems - A Real Options AnalysisSeptember 28, 2021To reduce greenhouse gas emissions and limit climate change, it is inevitable that the share of renewable energy production must increase. Countries all over the world have introduced support schemes in order to accelerate investment in renewable energy. Many of these support schemes have been retracted or revised unexpectedly over the last years, affecting firms and investors negatively. It is, therefore, interesting to study how the investment strategy of a firm in renewable energy projects is affected by subsidy availability and withdrawal. Another challenge for practice is the question of how regulators can design sustainable and effective policies. Photos from Unsplash Roel Nagy‘s...

InvestExL: Investment under Uncertainty in the Future Energy Systems - A Real Options AnalysisSeptember 28, 2021To reduce greenhouse gas emissions and limit climate change, it is inevitable that the share of renewable energy production must increase. Countries all over the world have introduced support schemes in order to accelerate investment in renewable energy. Many of these support schemes have been retracted or revised unexpectedly over the last years, affecting firms and investors negatively. It is, therefore, interesting to study how the investment strategy of a firm in renewable energy projects is affected by subsidy availability and withdrawal. Another challenge for practice is the question of how regulators can design sustainable and effective policies. Photos from Unsplash Roel Nagy‘s... -

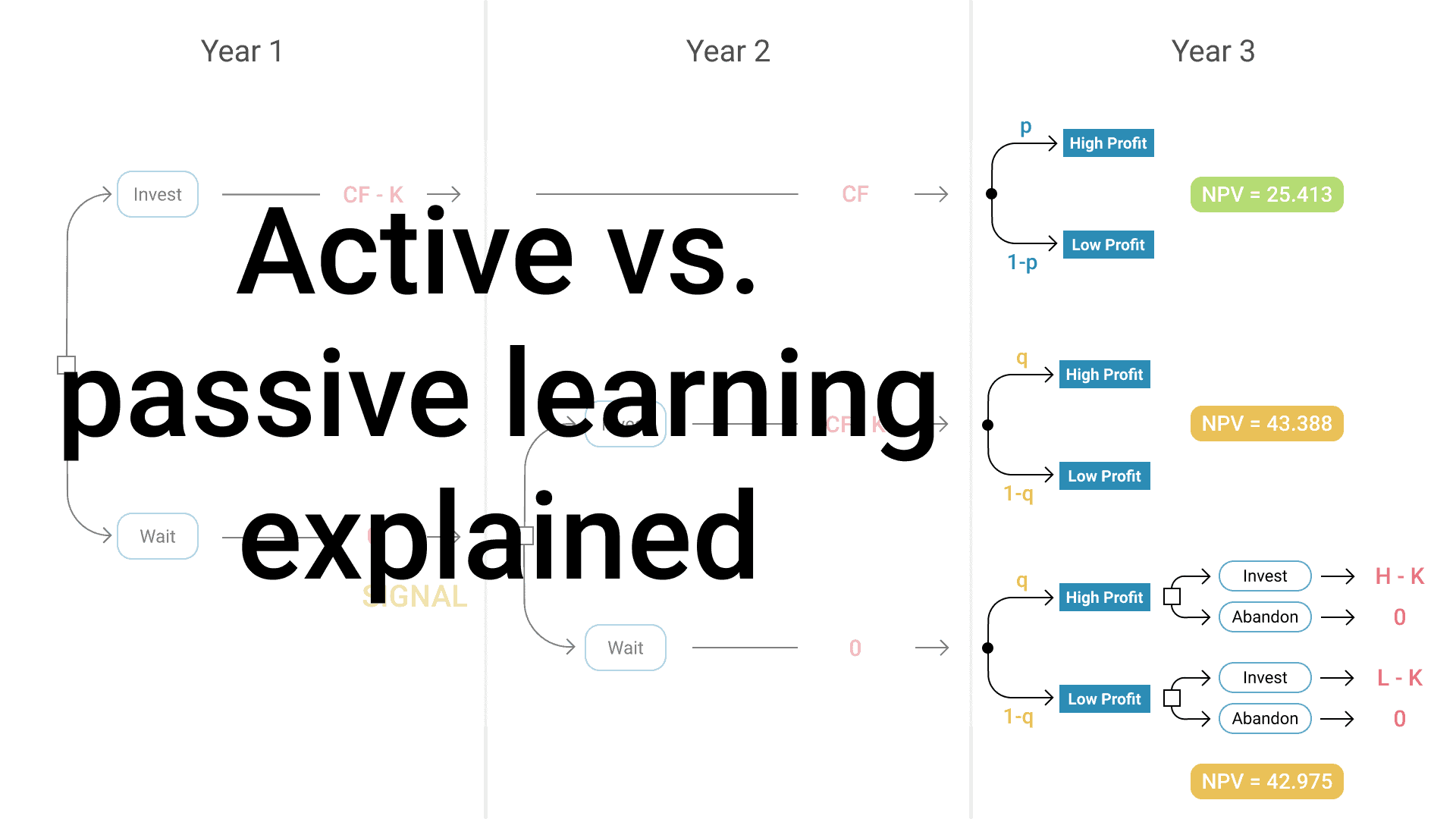

Active vs. passive learning explainedMarch 19, 2021How can firms use signals from policy makers more efficiently to make better decisions? In standard real options models, learning is viewed as a passive consequence of observing the evolution of expected profits over time. In the InvestExL project, we take a new approach that encourages active information acquisition. Firms receive signals that they use to update their beliefs about the future profitability of a project. The opportunity to learn gives rise to an additional trade-off between investing now and waiting. Compared to standard real options literature, this allows for a more realistic treatment of the investment scenario in which information...

Active vs. passive learning explainedMarch 19, 2021How can firms use signals from policy makers more efficiently to make better decisions? In standard real options models, learning is viewed as a passive consequence of observing the evolution of expected profits over time. In the InvestExL project, we take a new approach that encourages active information acquisition. Firms receive signals that they use to update their beliefs about the future profitability of a project. The opportunity to learn gives rise to an additional trade-off between investing now and waiting. Compared to standard real options literature, this allows for a more realistic treatment of the investment scenario in which information... -

Phd Winter School on Real Options and Commodity MarketsMay 7, 2018On March 18-23 the PhD Winter School on Real Options and Commodity Markets was held in Tauplitz, Austria. The school was organized by the Norwegian University of Science and Technology (NTNU) and CenSES. 30 participants spent the week attending morning and afternoon sessions in which international lecturers conveyed both state-of-the art knowledge and recent advances on real options analysis and commodity finance with a special focus on energy markets. During a generous lunch break, the participants had the possibility to enjoy downhill and cross-country skiing in the ski area Die Tauplitz, winter walks in the picturesque village Tauplitz or some relaxing...

Phd Winter School on Real Options and Commodity MarketsMay 7, 2018On March 18-23 the PhD Winter School on Real Options and Commodity Markets was held in Tauplitz, Austria. The school was organized by the Norwegian University of Science and Technology (NTNU) and CenSES. 30 participants spent the week attending morning and afternoon sessions in which international lecturers conveyed both state-of-the art knowledge and recent advances on real options analysis and commodity finance with a special focus on energy markets. During a generous lunch break, the participants had the possibility to enjoy downhill and cross-country skiing in the ski area Die Tauplitz, winter walks in the picturesque village Tauplitz or some relaxing... -

PhD Winter School on Real Options and Commodity Markets, Tauplitz (Austria), March 18-23December 8, 2017We are organizing a Winter School on Real Options and Commodity Markets in Tauplitz, Austria, 18-23 March 2018. The winter school aims to bring together 30 PhD students with international experts in the field of real options and/or commodity finance. The lecturers will convey state-of-the art knowledge as well as recent advances on real options analysis and commodity finance with a special focus on energy markets. All lecturers will be available for discussion throughout the week. For more information see: https://www.ntnu.edu/web/winterschoolrocm2018/. Register fast – places are allocated at a first come basis!

PhD Winter School on Real Options and Commodity Markets, Tauplitz (Austria), March 18-23December 8, 2017We are organizing a Winter School on Real Options and Commodity Markets in Tauplitz, Austria, 18-23 March 2018. The winter school aims to bring together 30 PhD students with international experts in the field of real options and/or commodity finance. The lecturers will convey state-of-the art knowledge as well as recent advances on real options analysis and commodity finance with a special focus on energy markets. All lecturers will be available for discussion throughout the week. For more information see: https://www.ntnu.edu/web/winterschoolrocm2018/. Register fast – places are allocated at a first come basis! -

New Knowledge-building Project for Industry received funding from the ENERGIX program of the Norwegian Research CouncilJanuary 20, 2017Investment under uncertainty in the future energy system: The role of expectations and learning EU’s and Norway’s ambitious climate and energy targets need to be fulfilled by making many small and large investment decisions. Each of these need to balance organizational objectives, profitability, and sustainability concerns, and will be made under considerable uncertainty regarding the future energy system. InvestExL will develop knowledge that assists decision makers and policy makers, using active learning to support investment processes in the Norwegian energy system, while at the same time delivering scientific contributions at the forefront of real options theory in the direction of...

New Knowledge-building Project for Industry received funding from the ENERGIX program of the Norwegian Research CouncilJanuary 20, 2017Investment under uncertainty in the future energy system: The role of expectations and learning EU’s and Norway’s ambitious climate and energy targets need to be fulfilled by making many small and large investment decisions. Each of these need to balance organizational objectives, profitability, and sustainability concerns, and will be made under considerable uncertainty regarding the future energy system. InvestExL will develop knowledge that assists decision makers and policy makers, using active learning to support investment processes in the Norwegian energy system, while at the same time delivering scientific contributions at the forefront of real options theory in the direction of... -

1st YARO WorkshopNovember 17, 2016The YARO workshop is a 2 day event and provides an opportunity for PhD students, post-doctoral researchers and other young academics to share their research and debate approaches as well as network with like-minded fellow researchers. We welcome real options papers from any field, e.g., competition and strategy, R&D, entrepreneurship and innovation, new product development, capabilities, infrastructure and network investments, valuation of natural resources, commodities and power investments, growth options, corporate valuation and IPOs, investments involving learning, agency issues and incentives, environmental protection and public policy.

1st YARO WorkshopNovember 17, 2016The YARO workshop is a 2 day event and provides an opportunity for PhD students, post-doctoral researchers and other young academics to share their research and debate approaches as well as network with like-minded fellow researchers. We welcome real options papers from any field, e.g., competition and strategy, R&D, entrepreneurship and innovation, new product development, capabilities, infrastructure and network investments, valuation of natural resources, commodities and power investments, growth options, corporate valuation and IPOs, investments involving learning, agency issues and incentives, environmental protection and public policy.

Recent articles

-

Real options approach for a staged field development with optional wellsReal options approach for a staged filed development with optional wells, S. Fedorov, V. Hagspiel and T. Lerdahl, 2021, accepted at Journal of Petroleum Science and Engineering

Real options approach for a staged field development with optional wellsReal options approach for a staged filed development with optional wells, S. Fedorov, V. Hagspiel and T. Lerdahl, 2021, accepted at Journal of Petroleum Science and Engineering -

Green Capacity Investment under Subsidy Withdrawal RiskGreen Capacity Investment under Subsidy Withdrawal Risk, R. L. G. Nagy, V. Hagspiel, and P. M. Kort, Energy Economics, Volume 98, 2021

Green Capacity Investment under Subsidy Withdrawal RiskGreen Capacity Investment under Subsidy Withdrawal Risk, R. L. G. Nagy, V. Hagspiel, and P. M. Kort, Energy Economics, Volume 98, 2021 -

Capacity optimization of an innovating firmCapacity optimization of an innovating firm, Verena Hagspiel, Peter M. Kort, Cláudia Nunes, Rita Pimentel, Kristian Støre, International Journal of Production Economics, Volume 233, 2021,

-

Green investment under time-dependent subsidy retraction riskGreen investment under time-dependent subsidy retraction risk, V. Hagspiel, C. Nunes, C. Oliveira, M. Portela, Journal of Economic Dynamics and Control, 2020, In Press

Green investment under time-dependent subsidy retraction riskGreen investment under time-dependent subsidy retraction risk, V. Hagspiel, C. Nunes, C. Oliveira, M. Portela, Journal of Economic Dynamics and Control, 2020, In Press

For students

Make sure to visit the For Students page, if you are a student looking for more information regarding your masters’s, project or PhD thesis.